Labour Pension Scheme: Now every labourer will get ₹5000 monthly benefit in their bank account!

Labour Pension Scheme: Central government employees gained a new retirement security option in 2025 with the Unified Pension Scheme (UPS), promising assured 50% of last pay as pension after 25 years of service. Announced alongside NPS enhancements, UPS addresses long-standing demands for guaranteed payouts over market-linked volatility, with family pension at 60% of retiree benefits and arrears for past NPS subscribers who opt in. This guide covers eligibility, calculations, timelines, and comparisons for informed decisions.

What is UPS and who qualifies

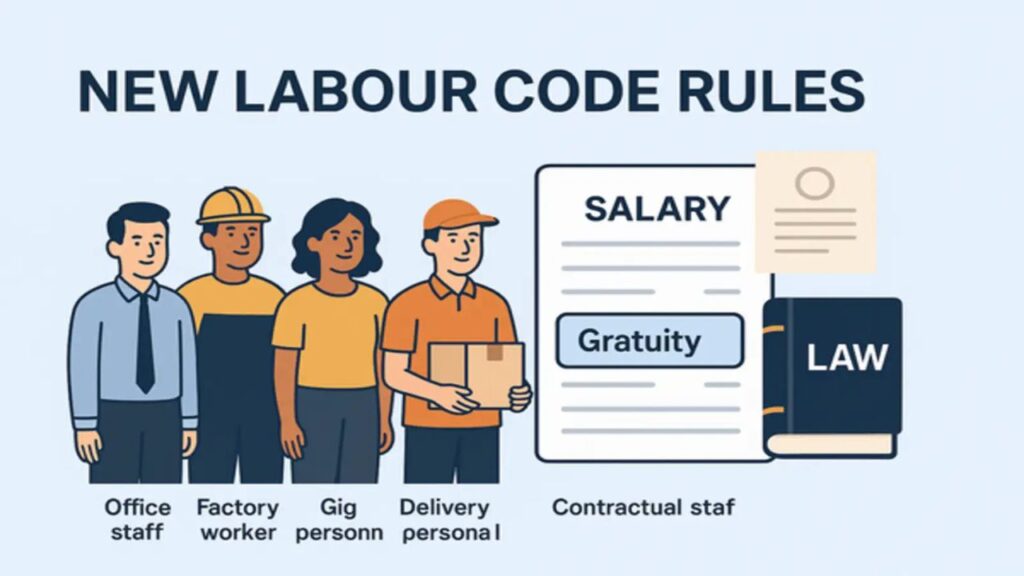

UPS targets central government employees under NPS, offering a shift to defined-benefit pensions without contribution changes. Launched via cabinet approval, it guarantees fixed payouts based on service and final salary, removing equity/debt market risks that defined NPS returns.

Eligibility criteria

- Current NPS subscribers in central government (civilian and defence).

- Minimum 25 years qualifying service for full 50% pension; proportionate for 10-24 years.

- Existing pensioners and families eligible for enhanced benefits.

- NPS Tier-I corpus transfers seamlessly to UPS fund.

States may adopt voluntarily; private sector excluded.

Assured pension formula and benefits

Pension equals 50% of average basic pay over last 12 months before superannuation, for 25+ years service. Pro-rata reduction applies below 25 years (e.g., 40% for 20 years). Minimum pension ₹10,000/month for 10+ years service.

Key benefits

- Inflation indexation via Dearness Relief, matching serving employees.

- No market risk—guaranteed regardless of NPS fund performance.

- Gratuity unchanged; additional lump sum of 1/10th monthly emoluments per six months service.

- Full pension restoration after 7 years for pre-2006 pensioners .

Family pension, arrears, and lump sum

Family pension steps to 60% of retiree amount upon death, with liberalized dependency rules. Arrears calculated as difference between NPS withdrawals and assured pension value from 2004 date of joining.

Lump sum addition

Read Also

- 1/10th of monthly emoluments (basic+DA) for every six months service.

- Paid at superannuation without reducing pension amount.

- NPS corpus remains intact for partial withdrawal (up to 60%) tax-free.

Opt-in process and deadlines

Existing NPS subscribers choose UPS irrevocably within six months of notification. Government funds shortfall between NPS corpus and assured liability.

Steps to opt-in

- Submit Form-1 via departmental head to CPAO within deadline.

- Auto-enrolment for new recruits post-notification.

- Irrevocable choice; NPS subscribers retain exit flexibility.

- States notify adoption separately for their employees .

UPS vs NPS: key differences

| Feature | UPS | NPS |

| Pension Guarantee | 50% assured after 25 years | Market-linked returns |

| Family Pension | 60% of retiree pension | Annuity-based (40% min) |

| Risk | None (govt-backed) | Equity/debt volatility |

| Inflation Protection | Dearness Relief | Returns-dependent |

| Exit Options | Fixed formula | 60% lump sum + annuity |

| Opt-in | Irrevocable for NPS staff | Default for new joins |

UPS suits risk-averse employees prioritizing stability; NPS better for growth-oriented with longer horizons .

Implementation timeline and next steps

Cabinet approval August 2024; scheme notification expected Q1 2025. CPAO handles migration; arrears disbursal prioritized for 2011-14 retirees.

Action checklist

- Check departmental circulars for Form-1 availability.

- Calculate provisional pension using online simulators.

- Consult bank/PAO for corpus transfer process.

- Track DoPT notifications for state adoption .

FAQs

Q1. Who is eligible for UPS pension scheme?

Central government employees under NPS qualify, including defence. Requires minimum 10 years service; full 50% pension after 25 years. New recruits auto-enrolled post-notification; existing staff opt-in irrevocably.

Q2. How is UPS pension amount calculated?

50% of average basic pay drawn over last 12 months before retirement, for 25+ years service. Pro-rata below 25 years; minimum ₹10,000/month. Dearness Relief adjusts for inflation .

Q3. What family pension benefits under UPS?

60% of retiree pension payable to spouse/children upon death. Enhanced dependency rules; no reduction for multiple claimants. Govt guarantees payments regardless of corpus .

Q4. Can NPS subscribers switch to UPS?

Yes, irrevocably within six months of notification via Form-1 to CPAO. Arrears paid for difference from 2004; NPS corpus transfers to UPS fund .

Q5. What happens to gratuity and lump sum in UPS?

Gratuity unchanged; additional lump sum = 1/10th monthly emoluments per six months service, without reducing pension. NPS 60% withdrawal option retained .

Conclusion

UPS delivers pension certainty long demanded by government staff, balancing NPS flexibility with assured 50% payouts and family protections. With opt-in deadlines approaching, review service records, simulate benefits, and submit choices promptly to secure enhanced retirement security.