ECGC Admit Card 2025: Application Guide Know Fees How to Apply & Admit Card Deadline!

Introduction

ECGC Admit Card 2025: ECGC, India’s government-owned export credit agency, is in the news for its 2025 Probationary Officer recruitment and ongoing measures to support exporters with enhanced risk covers and digital processes. This guide explains what ECGC is, the latest updates, eligibility and dates for PO hiring, and how its schemes protect exporters and banks ECGC Limited is a Government of India enterprise under the Ministry of Commerce and Industry that provides export credit insurance to Indian exporters and guarantees to banks, reducing commercial and political risks in cross-border trade. The corporation’s policies and guarantees help MSMEs and large exporters access finance, expand markets, and protect cash flows.

What is ECGC

ECGC was established in 1957 to promote Indian exports by offering credit risk insurance and related services against buyer default, insolvency, and political events. It covers exporters and banks, enabling smoother access to pre-shipment and post-shipment finance and improving the credibility of exporters with lenders worldwide.

Latest news and updates

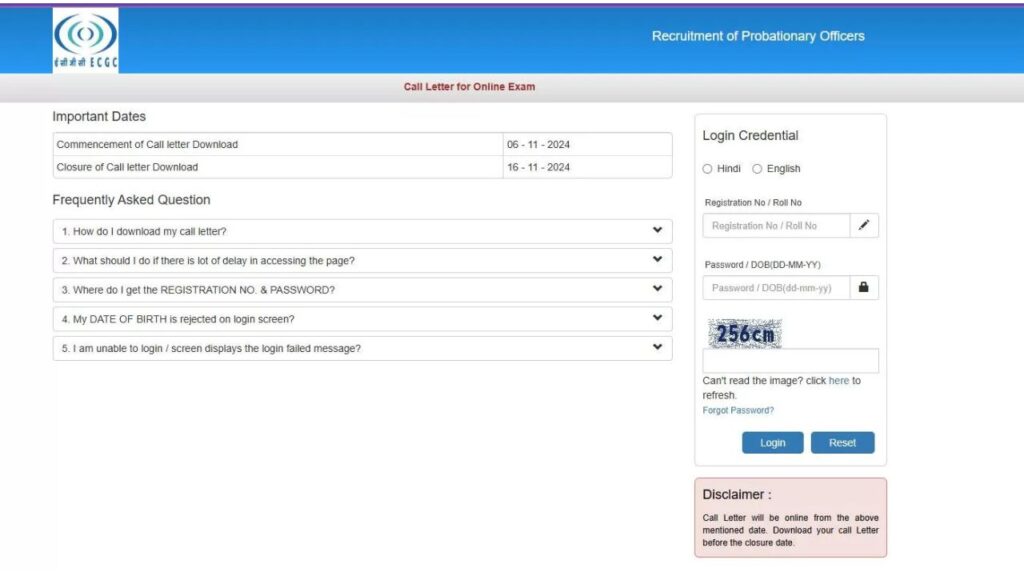

ECGC PO Notification 2025 has been released, announcing 30 vacancies with online applications from 11 November to 2 December 2025, and an online exam on 11 January 2026.ECGC has focused on enhanced cover for banks, digitalization of processes, and measures to help exporters navigate tariff disruptions; exports supported in FY24-25 stood at ₹8.55 lakh crore.Government earlier approved capital infusion of ₹4,400 crore over FY22–FY26 to expand underwriting capacity and support additional exports via increased risk coverage.

ECGC PO 2025 recruitment

The 2025 ECGC PO recruitment opens 30 posts across Generalist and Specialist streams with a two-stage selection: an online examination and interview for shortlisted candidates. Registration runs from 11 November to 2 December 2025, with the online exam scheduled for 11 January 2026; interviews follow in early 2026.

Key dates at a glance

- Detailed advertisement: 10 November 2025.

- Online registration: 11 November–2 December 2025.

- Exam date: 11 January 2026 (2:00–5:00 PM).

Salary and roles

Indicative annual compensation for ECGC POs is positioned competitively in public sector finance roles and detailed in the official notification and partner advisories. Roles typically cover underwriting, risk assessment, claims, and exporter/bank servicing depending on Generalist or Specialist tracks.

Key ECGC products and covers

Export credit insurance: Protects exporters against commercial risks like buyer insolvency, protracted default, and political risks such as war or exchange restrictions.Bank guarantees/cover: Guarantees to banks for pre-shipment and post-shipment finance to exporters, including enhanced cover for small exporters in recent measures.Overseas investment insurance: Political risk insurance for Indian companies investing abroad, covering expropriation and transfer restrictions.Factoring and receivables support: Improves liquidity by managing foreign receivables and ensuring timely payments.

Benefits for exporters and banks

- Risk mitigation: Comprehensive commercial and political risk cover stabilizes cash flows and reduces defaults.

- Access to credit: Insurance-backed credibility enables larger working capital and term loans from banks at competitive terms.

- Market expansion: Confidence to enter new geographies with country risk insights and cover availability.

- Bank risk transfer: Higher cover percentages, particularly for MSME-linked export credit, de-risk lender portfolios.

Eligibility highlights and timelines

For ECGC PO 2025, the basic eligibility includes age limits typically 21–30 years as of a specified cut-off date and graduation qualifications per post-specific criteria. Candidates must apply within the published window and appear for the online exam followed by interviews at designated centers.

Read Also

How ECGC strengthens exports

Capital infusion approved by the government increases ECGC’s underwriting capacity, enabling more policies and bank covers to back export growth, especially in labor-intensive sectors. With enhanced digitalization and higher bank cover for small exporters, ECGC aims to reduce friction and cost for trade finance access while improving resilience to external shocks.

Scannable bullets: quick takeaways

ECGC is India’s state-owned export credit agency offering insurance to exporters and guarantees to banks 2025 PO recruitment: 30 vacancies, apply 11 Nov–2 Dec 2025; exam on 11 Jan 2026 Products: exporter policies, bank cover, overseas investment insurance, and factoring services. Policy focus: enhanced cover for small exporters, digital processes, and tariff disruption support. Government support: 4,400 crore capital infusion across FY22–FY26 to scale underwriting.

FAQs

Q1: What does ECGC do for exporters?

ECGC provides credit insurance that covers non-payment risks from foreign buyers and political disruptions, helping exporters secure bank finance and expand to new markets with reduced risk exposure.

Q2: What’s new in ECGC PO Recruitment 2025?

ECGC has announced 30 PO vacancies with online registration from 11 November to 2 December 2025 and an online exam on 11 January 2026, followed by interviews in early 2026 for shortlisted candidates.

Q3: How does ECGC support banks?

ECGC offers guarantees to banks for export credit loans, with recent enhancements including higher cover for small exporters to make lending safer and more cost-effective for lenders.

Q4: Why did the government infuse capital into ECGC?

The ₹4,400 crore infusion across FY22–FY26 expands ECGC’s capacity to underwrite risks, enabling more policies and higher coverage limits to support additional export volumes across sectors.

Q5: Which risks are typically covered by ECGC?

ECGC covers commercial risks like insolvency and protracted default, and political risks such as war, expropriation, and exchange transfer restrictions that can block or delay payments.

Internal link anchors

- Visit ECGC official website for recruitment and schemes: ECGC official site.

- Review organization profile and services: ECGC company profile.

Conclusion

ECGC plays a critical role in India’s export ecosystem by de-risking trade, enabling credit, and supporting MSMEs through focused schemes and bank guarantees. For applicants, apply within the ECGC PO 2025 window and prepare for the January exam; for exporters and banks, review current policies and enhanced covers to optimize risk and financing.