2025 Sukanya Samriddhi Yojana (SSY) Review: Post Office Scheme for Girl Child Savings at 8.2% Interest!

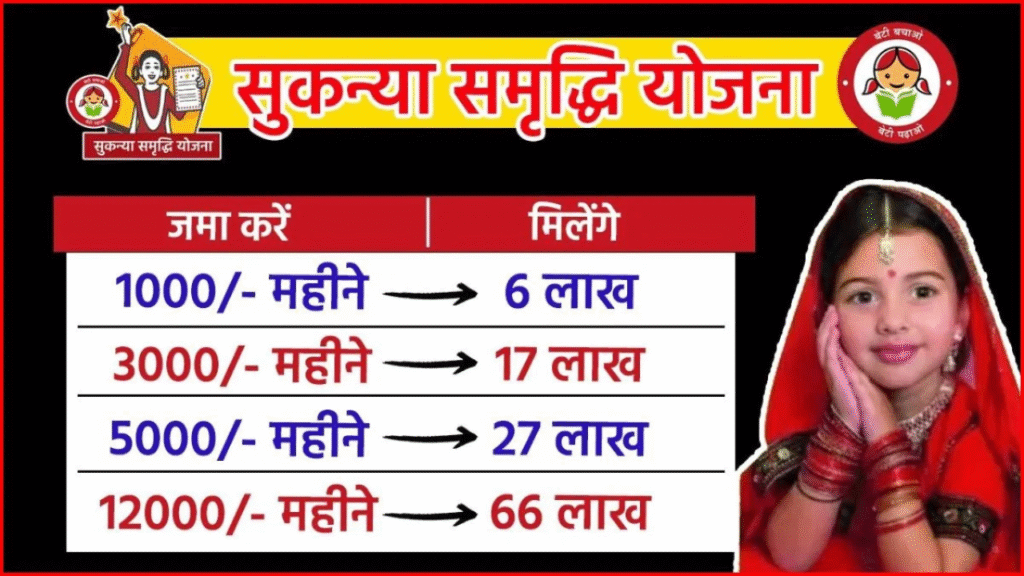

As a parent who has explored various long-term savings options for my daughter’s future, government-backed schemes like Sukanya Samriddhi Yojana stand out for their safety and predictability. Launched under Beti Bachao Beti Padhao, SSY allows ₹12,000 monthly deposits (₹1.44 lakh annually) in a girl’s name, potentially growing to around ₹69 lakh over 21 years at the current 8.2% rate—though actual returns depend on quarterly revisions. I calculated scenarios using official rates to assess its fit for education or marriage funding.

Quick Verdict

✅ High 8.2% compounded annually (Q4 2025) with EEE tax status—principal, interest, and maturity fully exempt.

✅ Flexible deposits from ₹250 to ₹1.5 lakh yearly, openable at post offices or banks for girls under 10.

✅ Maturity after 21 years from opening, with partial withdrawals allowed post-18 for specific needs.

✅ Government guarantee ensures capital protection unlike market-linked plans.

⚠ Long 21-year lock-in limits liquidity; premature closure penalties apply.

⚠ Only for girl children—parents/guardians operate till age 18.

⚠ Interest rates reviewed quarterly, could decrease over time.

Key Features

- Account opens for girls under 10 years; maximum two accounts per family.

Annual deposit limit ₹1.5 lakh (minimum ₹250); contributions for first 15 years.

8.2% interest (Oct-Dec 2025) compounded yearly on lowest monthly balance.

Maturity at 21 years from opening; partial withdrawal up to 50% after girl turns 18 for education/marriage.

Tax benefits under Section 80C (up to ₹1.5 lakh deduction); EEE status.

Available at 1.6 lakh+ post offices and select banks; transferrable across branches.

-

Interest Rate Performance

Interest credits annually based on the lowest balance between 5th-30th of each month. At 8.2%, ₹12,000 monthly (₹1.44 lakh yearly) over 15 years totals ₹21.6 lakh invested, growing to approximately ₹69 lakh at maturity (21 years), with ₹47 lakh interest—assuming constant rate. Rates have ranged 7.6-8.5% since 2016; quarterly resets track government securities. Example: Q3 2025 held steady, but drops occurred in 2020-23.

Account Longevity

Account runs 21 years total; deposits stop after 15 years, but interest accrues on balance. No contributions needed years 16-21, yet growth continues. Premature closure possible after girl turns 18 (80% withdrawal) or on death (full refund + interest). Passes to girl at 18 or parents till then. Longevity suits goals like higher education (age 21) or marriage.

Accessibility and Rules

Parents/guardians open/manage till girl is 18; she operates post that till maturity. One-time penalty ₹50/year for missed minimum deposit. Post offices offer agentless service; banks like SBI add passbook tracking. Digital updates via India Post Payments Bank app in select areas. Transfers free between post offices; ₹100 fee for banks.

Practical Usage

Start at birth: deposit ₹12,000 monthly via cash/cheque/UPI at counter. Track via passbook; interest auto-credits March 31 yearly. For education, withdraw 50% post-18 with proof. Example family: ₹1.44 lakh yearly from age 1 yields ~₹69 lakh at 21, covering college fees. Monsoon queues common at rural post offices; urban branches faster.

Pros and Cons

Pros

- Highest safe returns among small savings at 8.2%.

Full tax exemption maximizes take-home.

Long-term compounding builds substantial corpus.

Nationwide post office access.

-

Cons

- Illiquid till maturity or specific conditions.

Girl-child only; no sibling flexibility beyond two.

Rate fluctuations possible quarterly.

Paper-based tracking in smaller branches.

-

Who Should Open It?

- Parents of newborn girls planning education funds.

Conservative savers prioritizing safety over liquidity.

Taxpayers maximizing 80C deductions.

Families in post office reach areas.

-

Who Should Skip It?

- Parents of boys or older girls (over 10).

Investors needing short-term access.

High-risk takers chasing equity growth.

NRIs ineligible for new accounts.

-

SSY vs Alternatives

| Scheme | Interest Rate | Lock-in/Tenure | Max Annual Deposit | Tax Status | Key Differences | ||||||

| SSY | 8.2% | 21 years | ₹1.5 lakh | EEE | Girl-only, highest rate; long lock. | ||||||

| | |||||||||||

| PPF | 7.1% | 15 years | ₹1.5 lakh | EEE | Anyone eligible, shorter tenure. | ||||||

| | |||||

| RD (5-year) | 6.9% | 5 years | No limit | Interest taxable | Monthly deposits, early access. |

| | |||||

| SCSS | 8.2% | 5 years | ₹30 lakh | EEE (partial) | Seniors only, quarterly payout. |

| |

SSY leads returns for girls, PPF flexibility for all.

Value for Money Score

9/10. Unbeatable safety + 8.2% + tax-free growth for 21-year goals; minor liquidity trade-off. Strong for dedicated parents.

Final Rating Table (Out of 10)

| Category | Rating | Notes | |||

| Returns/Performance | 9/10 | Top small savings rate, compounding power. | |||

| | |||||

| Security/Longevity | 10/10 | Govt-backed, proven 10+ years. | |||

| | ||

| Accessibility/Rules | 8/10 | Post-wide, but girl-specific. |

| | ||

| Features | 7.5/10 | Basic tracking, no digital bells. |

| | ||

| Overall | 9/10 | Premier girl child savings tool. |

| |

Expert Verdict

Sukanya Samriddhi Yojana offers secure, high-yield growth for daughters’ futures via disciplined saving. Calculate your scenario at a post office—best for committed long-haul planners.

FAQs

- What is current SSY interest rate?

8.2% p.a. compounded yearly (Oct-Dec 2025); quarterly review.

Can I deposit ₹12,000 monthly?

Yes, totals ₹1.44 lakh yearly (under ₹1.5 lakh cap).

Maturity for ₹12k monthly over 15 years?

Around ₹69 lakh at 21 years (at constant 8.2%).

Tax benefits?

80C deduction on deposits; EEE on all proceeds.

Withdrawal rules?

50% post-18 for education/marriage; full at 21 years.

Eligible age for girl?

Under 10 years at opening.

Vs PPF?

Higher rate, girl-only, longer tenure.